Learn how to write closing journal entries for revenue, expense, and dividend accounts. Temporary account balances can either be shifted directly to the retained earnings account or to an intermediate account known as the income summary account beforehand. As part of the closing entry process, the net income (NI) is moved into retained earnings on the balance sheet. The assumption is that all income from the company in one year is held onto for future use. Any funds that are not held onto incur an expense that reduces NI. One such expense that is determined at the end of the year is dividends.

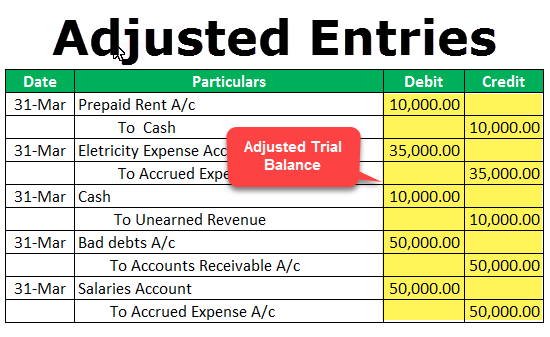

Companies prepare an income summary and an income statement at the end of an accounting period. The income summary account is also known as the temporary income statement account. Temporary accounts are those that are closed at the end of an accounting cycle. Transferring the expense account to the account is similar to the revenue account process. However, rather than credit the expense balance to transfer it, businesses must debit it, given that expenses are already credited.

What Are Temporary Accounts in Accounting?

Let’s look at the trial balance we used in the Creating Financial Statements post. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. The net profit, which in this case is $1, 500,000, can be transferred into the retained earnings account. The business has earned interest income of $8,000, revenues of $90,000, and miscellaneous income of $7,400.

The final, or the arriving balance, reports the statement profit or loss. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Next, the balance resulting from the closing entries will be moved to Retained Earnings (if a corporation) or the owner’s capital account (if a sole proprietorship).

First, transfer the $5,000 in your revenue account to your income summary account. Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses. You need to create closing journal entries by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits. Looking at the revenue account balance, all the revenue-generating sources, whether operating or non-operating business functions are included in the process.

Beginning Balances and Closing Entries on an Income Summary

Once all the revenue streams have been compiled, businesses credit them to transfer to the summary. When comparing the two columns, it is essential to look at their totals. If the credit balance exceeds the debit balance, it indicates a profit. On the other hand, if the debit balance is greater than the credit balance, it indicates a loss. Think about some accounts that would be permanent accounts, like Cash and Notes Payable. While some businesses would be very happy if the balance in Notes Payable reset to zero each year, I am fairly certain they would not be happy if their cash disappeared.

In the manual accounting system, the company uses the income summary account to close the income statement at the end of the period. It helps in maintaining the overall audit trail of revenues earned by the business and the expenses incurred by the business. The business and auditors can always go back to such statements to determine and investigate any amounts they think are doubtful or just want to cross verify for investigation purposes. Income summaries are temporary accounts that net all the revenue and expenses accounts to determine whether there was a credit balance (profit) or debit balance (loss).

According to the statement, the balance in Retained Earnings should be $13,000. An investment and research professional, Jay Way started Income Summary Account writing financial articles for Web content providers in 2007. He has written for goldprice.org, shareguides.co.uk and upskilled.com.au.

How to create closing entries

Finally, you are ready to close the income summary account and transfer the funds to the retained earnings account. The retained earnings account is reduced by the amount paid out in dividends through a debit, and the dividends expense is credited. The purpose of the closing entry is to reset the temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data. If the Income Summary has a debit balance, the amount is the company’s net loss. The Income Summary will be closed with a credit for that amount and a debit to Retained Earnings or the owner’s capital account. Next, if the Income Summary has a credit balance, the amount is the company’s net income.

- This way each accounting period starts with a zero balance in all the temporary accounts, so revenues and expenses are only recorded for current years.

- One such expense that is determined at the end of the year is dividends.

- In this article, we will look at why the process is necessary and discuss the role played by the Income Summary account at the end of a fiscal year.

When the accounting period ends, all the revenue accounts are closed when the credit balance is properly transferred. This involves debiting the revenue accounts to reset them with zero balance and crediting the final temporary account. While the income statement is used for recording expenses and revenues for a given accounting period, the income summary account holds closing records of revenues and expenses. The income summary is, therefore, a temporary account as it holds a zero balance throughout the year until the year ending closing entries are made. Accountants transfer its closing entries into the Retained Earnings account consequently resulting in its closing.

What is the Income Summary Account?

Once all the temporary accounts are compiled, the value of each account is then debited from the temporary accounts and credited as a single value to the income summary. After these two entries, the revenue and expense accounts have zero balances. Rather than closing the revenue and expense accounts directly to Retained Earnings and possibly missing something by accident, we use an account called Income Summary to close these accounts. Income Summary allows us to ensure that all revenue and expense accounts have been closed.

Guaranteed income in retirement – Inside INdiana Business – Inside INdiana Business

Guaranteed income in retirement – Inside INdiana Business.

Posted: Mon, 21 Aug 2023 10:00:00 GMT [source]

Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. The first step in preparing it is to close all the revenue accounts. Notice the balance in Income Summary matches the net income calculated on the Income Statement.

What is the Income Summary account?

This is the first step to take in using the income summary account. Additionally, it is important to note that the income summary account plays both roles of the debit and the credit at the same time when the company closes the income statement at the end of the period. For example, the expenses are transferred to the debit side of the income summary while the revenues are transferred to the credit side of the income summary.

- Income Summary allows us to ensure that all revenue and expense accounts have been closed.

- Starting with zero balances in the temporary accounts each year makes it easier to track revenues, expenses, and withdrawals and to compare them from one year to the next.

- This will be identical to the items appearing on a balance sheet.

- The balances in each of the temporary accounts would then be closed out in either capital account as applied for sole proprietorship business and retained earnings as applied for the corporation.

The Income Summary account is used when closing entries are processed to close the revenue and expense account balances. If you paid out dividends during the accounting period, you must close your dividend account. Now that the income summary account is closed, you can close your dividend account directly with your retained earnings account.

While income summaries can provide significant benefits to companies that use them for accounting purposes, there are also some disadvantages to keep in mind. Many of these come in the form of understanding what each section of the document means and interpreting it. “Closing the books” is an important process in the life cycle of any company. It is necessary for both reporting and tax purposes and helps management assess the health and well-being of the business. In this article, we will look at why the process is necessary and discuss the role played by the Income Summary account at the end of a fiscal year.

Income Summary Disadvantages

The company can make the income summary journal entry for the revenue by debiting the revenue account and crediting the income summary account. The income summary is a temporary account that its balance is zero throughout the accounting period. The company only uses this account at the end of the period to clear all accounts in the income statement. Likewise, after transferring the balances of all accounts in the income statement to the balance sheet, the income summary balance will become zero again. If the balance on the final account is a loss (debit balance), companies have to credit the lost amount to the retained earnings.

If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account. Without closing revenue accounts, you wouldn’t be able to compare how much your business earns each period because the amount would build up. And without closing expense accounts, you couldn’t compare your business expenses from period to period.