Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends. Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products.

Why contribution is important in financial management?

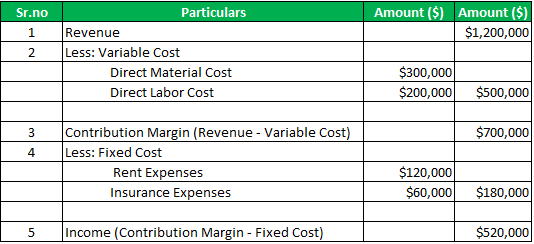

At breakeven, variable and fixed costs are covered by the sales price, but no profit is generated. You can use contribution margin to calculate how much profit your company will make from selling each additional product unit when breakeven is reached through cost-volume-profit analysis. If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making.

Contribution Margin Ratio Formula:

Businesses calculate their contribution margin as a total contribution margin or per-unit amount for products. You can show the contribution margin ratio as CM relative to sales revenue. And you can also compute the variable expense ratio, which is the percentage of variable expenses divided by sales. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income. Each profit measure can be expressed as total dollars or as a ratio that is a percentage of the total amount of revenue. Cost accountants, financial analysts, and the company’s management team should use the contribution margin formula.

Use of Contribution Formula

- However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation.

- For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit.

- So, it is an important financial ratio to examine the effectiveness of your business operations.

Another common example of a fixed cost is the rent paid for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold. However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis. A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse. This is one reason economies of scale are so popular and effective; at a certain point, even expensive products can become profitable if you make and sell enough.

A business has a negative contribution margin when variable expenses are more than net sales revenue. If the contribution margin for a product is negative, management should make a decision to discontinue a product or keep selling the product for strategic reasons. A good contribution margin is one that will cover both variable and fixed costs, to at least reach the breakeven point. A low contribution margin or average contribution margin may get your company to break even. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs.

Formula For Contribution Margin

In conclusion, we’ll calculate the product’s contribution margin ratio (%) by dividing its contribution margin per unit by its selling price per unit, which returns a ratio of 0.60, or 60%. In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. It helps investors assess the potential of the company to earn profit and the part of the revenue earned that can help in covering the fixed cost of production. The business can interpret how the sales figures are affecting the overall profits.

Furthermore, a higher contribution margin ratio means higher profits. This means that you can reduce your selling price to $12 and still cover your fixed and variable costs. Contribution margin analysis is the gain or profit that the company generates from the sale of one unit of goods or services after deducting sacrificing ratio meaning example formula etc the variable cost of production from it. The calculation assesses how the growth in sales and profits are linked to each other in a business. The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product.

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period. This is if you need to evaluate your company’s future performance. The following are the steps to calculate the contribution margin for your business.

For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. Variable expenses directly depend upon the quantity of products produced by your company. For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost. Calculate the total contribution margin ratio by dividing the total of all contributions you calculated in Step 2 by the total sales revenue from Step 1 (you have to have both numbers to calculate this). Contributions margin ratio (also known as gross profit ratio) is one of the most important financial ratios. It measures how profitable a company is with each dollar of sales revenue.